Most of the time, the drawdown is minuscule and nothing to worry about. Thus, most of the time, you’ll be in a drawdown! You are in a drawdown if your equity is not at an all-time high.

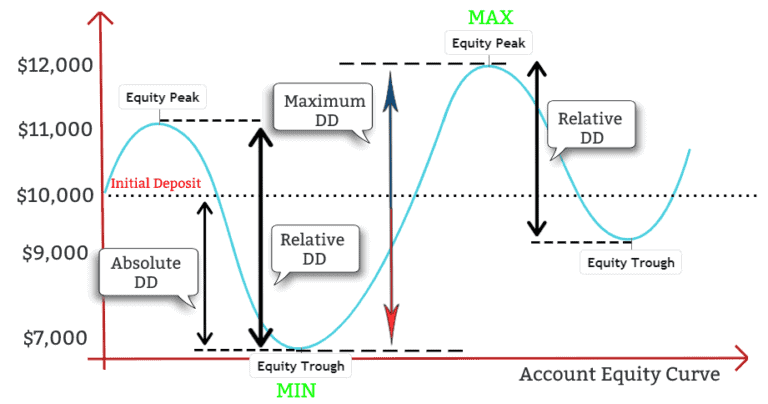

It’s a peak-to-trough decline over a certain period. Conclusion: Why is max drawdown important in trading?Ī drawdown in trading is the percentage you are down from the latest equity peak.Trading is about preserving your capital.How Much Pain Can You Take? Risk, Hindsight, Consistency And Paper Trading.Preparing the mind for inevitable drawdowns.It’s easier to predict risk than returns.Changes that have taken place over the last 180 years.Looking at drawdowns over a period of 180 years.Drawdown in a historical perspective – 180 years of stock market drawdowns.The biggest trading drawdown is yet to come.When you add a strategy to your portfolio, make sure it adds diversification and is uncorrelated with the other strategies.Trade small sizes and stay well within your comfort zone.Trade many markets – low correlation reduces trading drawdowns.Reduce and decrease trading drawdowns by trading many strategies.Align your trading style with your personality.Most strategies stop working sooner or later.Don’t avoid drawdowns in trading- accept them and use them to your advantage.Why you need to accept drawdowns as part of cost of doing business.Drawdowns and the Sharpe ratio – the least amount of pain for the same return.Low drawdowns can take advantage of leverage.

0 kommentar(er)

0 kommentar(er)